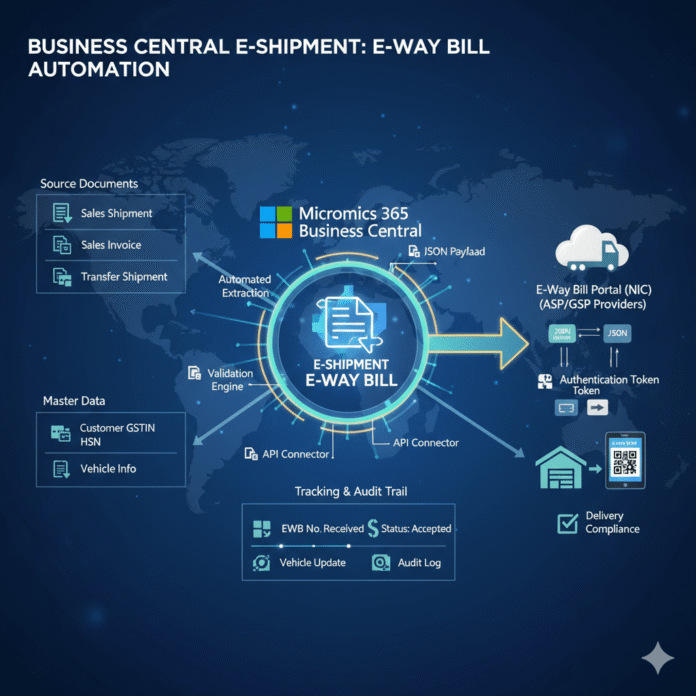

Managing E-Way Bills inside Business Central is becoming a key part of digital compliance for Indian businesses. With the rise of e-documents, automated logistics, and smoother regulatory workflows, Business Central’s E-Shipment framework gives companies a smarter way to handle E-Way Bill generation, tracking, and reconciliation.

The entire process—once filled with manual data entry and repetitive verification—is now faster, cleaner, and much more reliable. Let’s walk through how it works, why it matters, and how you can make the most of it.

What Is E-Shipment in Business Central?

E-Shipment is Business Central’s advanced electronic document capability designed to handle digital shipments, transfer shipments, and related compliance documents. It centralizes logistics information so businesses can send structured data to external authorities or transport partners.

Think of E-Shipment as a digital courier that ensures every shipment complies with the rules before it hits the road.

Why E-Way Bill Matters in the E-Shipment Workflow

In India, any goods transported with a value above the prescribed limits must carry an E-Way Bill. It includes data like:

- Invoice details

- Transporter information

- Vehicle numbers

- GST registration details

- Origin and destination

E-Shipment lets Business Central users generate and validate these details without leaving the system. No switching screens. No manual uploads. Everything flows from your posted documents.

How to Configure E-Shipment for E-Way Bills in Business Central

Before you can generate E-Way Bills, the foundations must be set up correctly.

Step 1: Enable E-Documents Feature

Turn on E-Document Core and E-Shipment in Feature Management.

Step 2: Configure E-Document Service Provider

Business Central supports API-based connections through:

- Government-authorized E-Way Bill ASPs

- Middleware integrations

- Third-party E-Invoice/E-Way Bill platforms

Simply plug in your credentials, endpoints, and tokens.

Step 3: Set Up GST and E-Way Bill Parameters

Key configurations include:

- Distance calculation method

- Default transporter

- Vehicle update permissions

- Document types for E-Way Bill generation

- Auto-capture of item HSN, value, taxable amount, and UOM

Step 4: Assign E-Shipment Document Type

Link the E-Shipment code to:

- Sales Shipment

- Sales Invoice

- Transfer Shipment

This ensures accurate data flow.

How E-Shipment Automatically Picks Up E-Way Bill Data

When you post a shipment or invoice, the E-Shipment engine extracts:

- Customer GSTIN

- Ship-from and ship-to addresses

- Item value and HSN

- Invoice amount

- Transport mode

- Vehicle details

- Approx. distance (auto-calculated)

It builds a ready-to-submit payload for the E-Way Bill portal.

You simply review → Submit → Download.

How to Generate E-Way Bill Using E-Shipment

Follow these quick steps:

1. Open Posted Sales Shipment / Invoice

Select Generate E-Shipment from the action bar.

2. Validate Extracted Fields

Ensure correct:

- GSTIN

- HSN

- Quantity & value

- Transporter ID

- Distance

3. Submit to E-Way Bill Portal

Click Submit E-Shipment.

Business Central sends the JSON payload via the configured API provider.

4. Retrieve E-Way Bill Number

Once approved:

- EWB number auto-updates

- Validity is captured

- PDF can be downloaded and shared

5. Track Status

You can view:

- Accepted

- Rejected

- Pending

- Cancelled

The system also allows cancellation within the permitted window.

How Vehicle Number Updates Work

Transport vehicles may change mid-journey. Business Central supports:

- Pre-dispatch vehicle entry

- Mid-transit vehicle update

- Automatic reflection of new validity

This ensures compliance even if the logistics plan changes.

How to Handle Transfer Shipments

Inter-branch movement also requires an E-Way Bill.

Business Central’s Transfer Shipment E-Document solves this by:

- Validating both location GSTINs

- Adding internal transport details

- Supporting distance and vehicle updates

This removes the need for manual submissions for branch-to-branch movements.

Does It Cover Integration Also?

Yes.

E-Shipment is designed to support API-based integration with:

- ASP/GSP providers

- Middleware E-Invoice platforms

- Custom integrations via Business Central APIs

The system handles:

- Token management

- Authentication

- Payload mapping

- Status synchronization

Any provider that exposes an E-Way Bill API can be integrated.

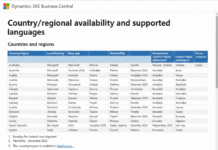

Does This E-Shipment Work Only for India?

No.

E-Shipment is a global framework inside Business Central.

However, the E-Way Bill feature is specific to India because E-Way Bills are a GST regime requirement.

Other countries can use E-Shipment for:

- Electronic export documents

- Local compliance forms

- Transport documents

- Industry-specific e-records

But only India uses the E-Way Bill model.

What Are the Common Challenges and How to Fix Them?

1. Incorrect GSTIN

Often caused by master data issues.

Fix by validating GSTIN in Customer or Vendor cards.

2. Wrong Distance Calculation

Update the distance manually when auto-calculation isn’t accurate.

3. HSN Not Detected

Populate item HSN codes correctly in Item Master.

4. API Authentication Errors

Refresh ASP authentication tokens or check expiry.

Does E-Shipment Support Cancelled or Rejected E-Way Bills?

Yes.

Business Central supports:

- Cancel submission

- Regenerate E-Shipment

- Resubmit updated request

This ensures full compliance even if mistakes happen.

Can You Automate E-Way Bill Generation?

Yes.

You can automate E-Way Bill creation using:

- Power Automate

- Background job queues

- Custom API triggers

For example:

“When a Sales Shipment is posted → Auto-generate E-Shipment → Auto-submit to ASP.”

Automation reduces turnaround time and avoids missed compliance deadlines.

Is E-Shipment Required If You Already Use an External ASP Portal?

Yes, if you want:

- Cleaner data consolidation

- No duplicate entry

- Fewer mistakes

- Better audit trails

- Integrated compliance

- Single dashboard for shipments

Even if your ASP portal works, E-Shipment enhances control and accuracy.

How E-Shipment Helps Audits and Compliance

Auditors often ask for:

- E-Way Bill number

- Validity

- Source document mapping

- Transport details

- Corrections and timelines

E-Shipment stores all of this inside Business Central, making audits faster and safer.

Is E-Shipment Useful for Companies Without GST?

If you handle logistics and require structured digital shipment records, yes.

Even without GST, the system helps manage:

- Export shipments

- Third-party logistics data

- Inter-warehouse movements

It becomes a centralized digital documentation system.

Conclusion

Managing E-Way Bills under E-Shipment in Business Central is one of the strongest compliance features available for Indian companies today. It cuts manual work, boosts accuracy, and ensures every shipment meets regulatory guidelines without switching platforms.

With automated data flow from posted documents, integrated API submissions, and advanced tracking, the E-Shipment engine transforms the way businesses handle logistics documentation.

As regulatory systems become more digital and integrated, Business Central users who adopt E-Shipment early will benefit from smooth compliance, faster operations, and better audit readiness.

FAQs

1. Can E-Shipment generate both E-Invoice and E-Way Bill together?

Yes. If the integration partner supports it, both can be generated in a single flow.

2. Is E-Shipment required for all shipments in Business Central?

Not required, but highly recommended for structured compliance and audit readiness.

3. Does E-Shipment support part-truck or multi-vehicle shipments?

Yes. Vehicle updates can be submitted multiple times during transit.

4. Can multiple branches use different ASP providers?

Yes. Each GST Location can have its own provider setup.

5. Will E-Shipment work in On-Premise Business Central?

Yes. As long as the environment can connect to the ASP APIs.